There are many old sayings in golf that golfers use everyday. Drive for show, putt for dough is one. Never up never in is another. My personal favorite, not so widely known outside of my regular golfing biddies is Nice drive a–hole, which always follows a great drive that ends up in a bogey or worse.

How about, I’d rather be lucky than good. That’s so popular among us hackers when we find a members bounce on a less than perfect strike.

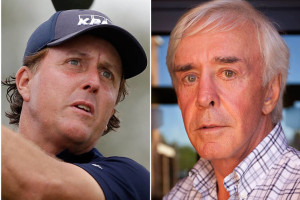

Well, I think we can apply that one to fan favorite Phil Mickelson.

Phil the Thrill was named as a “relief defendant” in a civil case by the SEC against his “friend” (translate that as bookie) Billy Walters. Seems Phil owed the noted professional gambler big bucks and Walters gave Phil a tip on a stock (Dean Foods) that Phil used to make some cash and pay Walters off what he owed him.

Unfortunately for Phil and more so for Walters his tip was inside information not available to the public. Walters got it from the former Dean Foods chairman and now both Walters and Davis are staring at the SEC and some time in jail. But not Phil.

From Joe Nocera’s New York Times article:

…let’s take a closer look at what the government said about Phil Mickelson’s behavior when it announced its indictment of his friend William T. Walters, a Las Vegas businessman and successful sports gambler. The facts, as laid out by the S.E.C., are not pretty. (Mickelson is not mentioned in the indictment, only in the S.E.C.’s civil charges against Walters.)

Walters, the government said, had been trading for years on insider information provided by Thomas C. Davis, a retired investment banker who was the chairman of Dean Foods. For a number of months in the spring and summer of 2012, Davis had been engaged in confidential Dean Foods board discussions about spinning off its organic food subsidiary, WhiteWave, a move Wall Street was encouraging. Davis — who has pleaded guilty and is cooperating with the government — had kept Walters informed about the discussions, and Walters had loaded up on the stock in anticipation of the spinoff.

At the time, Mickelson owed Walters gambling debts. Although he was a serious gambler, Mickelson was not a big stock trader, with only about $250,000 in the market, according to the S.E.C. Yet on July 30 and 31, 2012, after a series of phone calls and texts with Walters, Mickelson bought $2.4 million worth of Dean Foods stock — some of it with money he borrowed. “These were his first ever Dean Foods purchases,” the S.E.C. noted.

You know, of course, what happened next: A week later, Dean Foods announced the WhiteWave spinoff. The stock jumped 40 percent. The very next day, Mickelson sold his Dean Foods stock, reaping a profit of $931,000.

Sounds like insider trading to me, but the SEC did not target Phil, probably because it is now more difficult to get a conviction.

A 2014 ruling by the U.S. Second Court of Appeals changed the landscape of insider trading prosecution. “…the court said, for a crime to have been committed, the company insider — the so-called tipper — had to have received a personal benefit in return for offering up inside information. In addition, the person who received the tip — the “tippee” — had to know that the tipper was receiving that personal benefit.”

In this case with Phil being the “tippee” the SEC may have had a hard time proving that he knew of any benefit to the “tippers” as they are called.

It’s a case of pure luck that Phil isn’t named in the indictment. Had the courts not made that ruling, which has been bashed by federal prosecutors whose job is more difficult now, he would be looking for some big time legal help instead of his swing.

The fact that Phil isn’t indicted doesn’t mean he didn’t do anything wrong. It means that the prosecutors had reservations about proving who knew what and when they knew it. But these facts are clear: Phil got inside information that he knew wasn’t common knowledge, he acted on it and made a substantial profit. Call it lucky he’s not in more trouble.

Unfortunately for us “little guys” who have modest market accounts and 4O1K’s invested in the market this stuff goes on all the time and the rich get richer and the little guy gets screwed. Don’t tell me it’s a victim-less crime and no one gets hurt. These guys are stealing money in a rigged game and they have all the cards.

I can’t wait for the next time Phil is in front of a microphone. He has to get asked about this and I am sure he is rehearsing his answers right now. He’ll probably try and deflect those questions with some legal mumbo jumbo his lawyers prepared for him and maybe try and go all Bill Belichick with something like, “I’m on to the U.S. Open.”

Yea, Phil’s luck hasn’t been so great at the U.S. Open.

But he got real lucky this time.

Click here for Nocera’s NY Times article.